Capital is out there,

are you ready?

INVESTMENT PREPERATION SERVICES

Raising capital as a start-up or mid-sized company can be a challenging and lengthy process, and there are several obstacles that entrepreneurs commonly face; these are the top three:

1.

LIMITED TRACK RECORD

Early-stage companies often lack a proven track record, which can make it difficult to attract investors. Investors typically seek evidence of a company's viability and potential for growth.

Without a history of revenue or profitability, start-ups must rely on their business plan, product or service concept, and the expertise of their founding team to convince investors of their potential.

2.

MARKET COMPETITION AND SATURATION

Many industries are highly competitive, and investors may be hesitant to fund start-ups entering markets that are already saturated or dominated by established players. Convincing investors that your start-up has a unique value proposition, and a competitive advantage can be a significant challenge.

3.

ACCESS TO INVESTORS

Access to potential investors is another hurdle. Entrepreneurs often struggle to connect with the right investors who are interested in their industry or sector. Building a network and establishing relationships with angel investors, venture capitalists, or other funding sources can be time-consuming and requires a proactive approach.

Whilst your management team should be completely comfortable with the product and the proposition, they might lack the experience and contacts to prepare the materials to attract and secure funding.

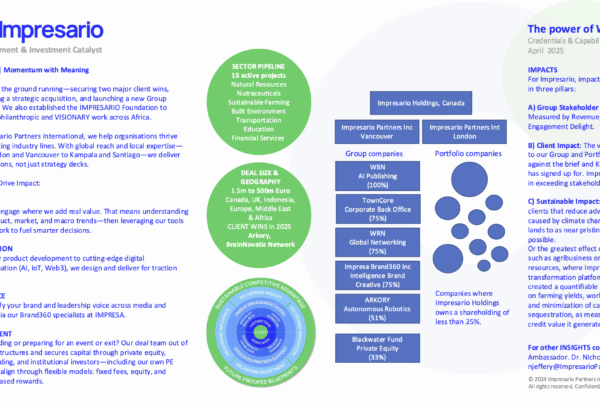

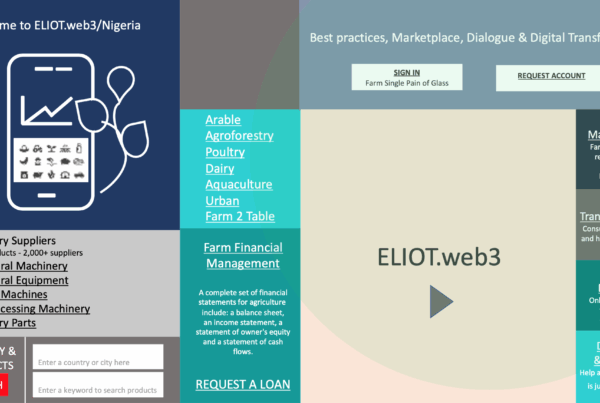

Impresario Partners International can help. We’re a hybrid Management and Investment House, focused on driving business turn around and growth in the IOT space where it intersects with key verticals:

• Logistics & Transportation

• Telecom, Media, and Technology

• Financial Services

• Natural Resources & Energy

• Built Environment

• Nutraceuticals

• Retail & Hospitality

With forty plus years of marketing communications, commercial strategy and investment banking experience to prepare a business for an event, such as taking on equity or debt, M&A, or IPO, we know how to help your business transition and grow.

Using a Canadian crowd funding platform, a network of private equity companies and high net worth’s on three continents, we have access to billions of dollars in a revolving line of funds to Invest in Equity and Debt and everything in between.

We solve business-critical challenges through our unique circle of offerings, INVESTMENT, INSIGHT, INNOVATION & INFLUENCE.

DO YOU NEED INVESTMENT FOR YOUR BUSINESS?

As you probably understand, there are numerous elements to prepare when starting on the journey to raise funds or an event like a merger or acquisition. To successfully engage investors, your information materials and narrative need to be prepared in a specific way and language.

Preparatory Investment Advisory Service

A) Impresario will ADVISE your team on how to create, refine and complete materials that are required:-

1. Information Deck & One Page Investor Teaser

2. Financial Projections and Proforma

3. Market & Competitive Opportunity Analysis

4. Team Information & Competences

5. Milestones and Roadmap

6. Early Revenue Valuation

7. Use of Funds

8. Data Room & Legal and Due Diligence Structure

B) We will train your pitch team on the right tone, topics to present to Investors, with FAQ examples to help you manage the dialogue.

C) By the end of the process Impresario will understand your business well and we will identify up to 12 target investors for you.

FEES & PROCESS

To deliver our Preparatory Investment Advisory Service, Impresario will assign a team of three people to cover Strategic & Financial , Creative and Operations.

This service normally takes 12 weeks (includes lapse time) with a fixed price of UKP 12,000.00 plus tax where applicable.

We will commence with a workshop (online call) between key stakeholders to ascertain state of play. This allows us to focus discussions and provide you with vital action points. During this session, should you discover that you require assistance in the creation of specific assets from the start as described in (A), you can ask us to scope and cost for the deliverables.

Terms: UKP 2,000 on account on day zero, engagement . UKP 4,000 billed on the first day and paid on the last day of each month for three months – last payment UKP 2,000. Local taxes apply.

You can be anywhere in the world for us to help; all we need is your business to:

- Be in early revenue looking for 5m investment.

- IOT/Web3 meets a key vertical sector (see list above)

- Have a written business plan and audited financials for the past years of trading.

CONTACT US

Want to find out more?

In the first instance please contact Founding and Managing Partner, Dr Nicholas F. Jeffery who can chat you though the Process and expected Outcome.

+36 20 426 3179 (Hungary)

njeffery@impresariopartners.com

linkedin.com/in/nicholas-jeffery

Case Studies

Service Capabilities